Comprehensive Risk Visibility

Gain complete insight into risks associated with residential real estate. Utilize our advanced property data solutions to enhance your analysis, ensuring reliable and informed decision-making in risk management.

Streamlined property risk assessments

Automated appraisal verification

ESG insights for informed decision-making

Regular revaluations for accurate coverage

Comprehensive Datasets and Precise Valuation

Utilize extensive property datasets to effectively value, analyze, and gather essential property information.

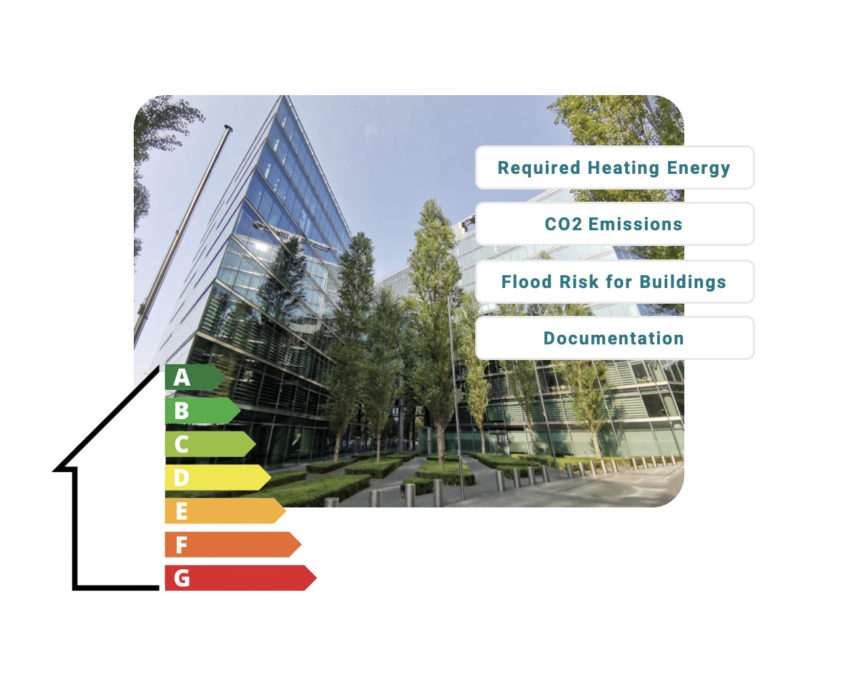

Energy Efficiency

The Arvio EE model provides assessments of energy efficiency and flood risk for any property, regardless of whether it has an issued energy performance certificate. The Arvio EE model has been independently validated through external verification.

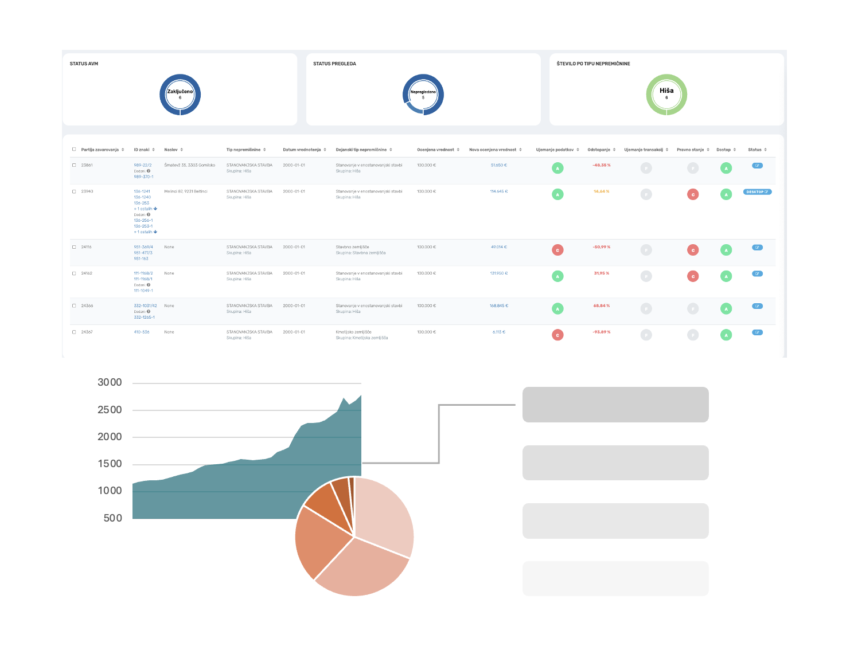

Portfolio Valuation

Arvio Portfolio is a tool for residential property valuation using the advanced statistical model Arvio AVM. External validation has confirmed the model’s compliance with the EBA guidelines and regulatory requirements of the Bank of Slovenia.

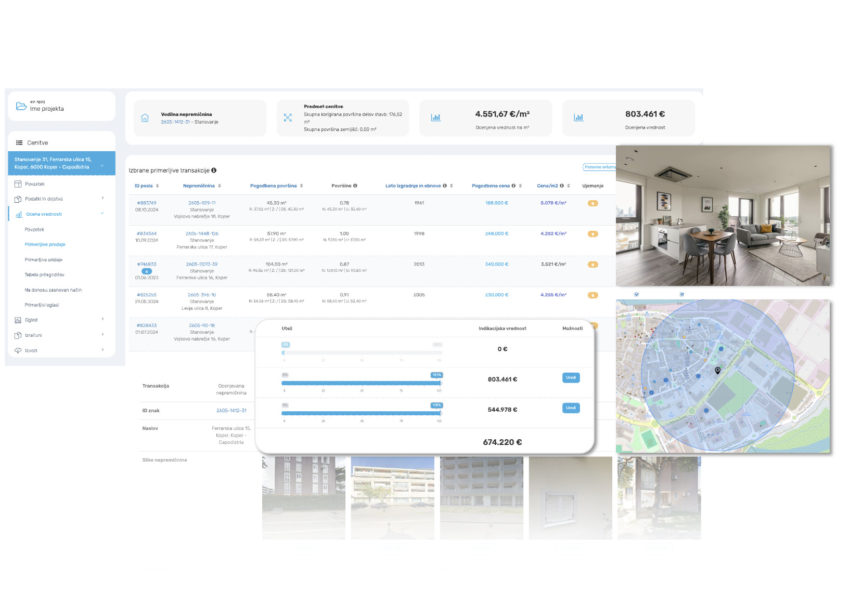

Precise Property Valuation

By entering the property ID or address, our system compiles comprehensive data for appraisal verification or execution. Utilizing an advanced statistical model, it conducts valuations through the sales comparison approach.

Integrating ESG in Insurance Strategies

As ESG standards gain traction, compliance will soon be mandatory for companies of all sizes. Properties not meeting these standards may incur higher financing costs, comparable to the difference between prime and subprime investments.

Advanced Predictive Modeling

Arvio’s predictive model assesses energy efficiency and flood risk, offering crucial insights for aligning with ESG requirements. This tool evaluates key factors like energy class and CO2 emissions, aiding insurance companies in strategic decision-making.

Vrednotenje portfelja

Energetska učinkovitost

AMAS za banke

Easier Review of Received Appraisals

Want to double the efficiency of your appraisal team?

Real estate appraisers reduce the analysis time of a property by 65% using our application. This tool simplifies data collection, performs analysis with advanced technologies, and provides automated export of completed analyses!

Effective Client Advisory

Have key property information ready at the first client meeting.

From the initial contact with a client interested in a mortgage, bank advisors need basic key information about the property offered as collateral. These details are just one click away—eliminating the need to search through databases and prepare data manually!

Streamlining the Appraisal Process

Know how many appraisals each appraiser completed? The average completion time?

By simply entering the property ID or address, you can access all the public record data needed to order an appraisal from a trusted appraiser. With just a click, easily obtain information on ordered, completed, and accepted appraisals.

Automated Appraisal Verification

Receive alerts for discrepancies or special conditions upon appraisal delivery.

Upon receiving an appraisal, the system offers an overview of key parameters and alerts you to any discrepancies that need to be reviewed by your insurance team. Real-time quality assurance!

Customer Stories

Z.T.

Risk Manager at a Bank

Ž.P.

Real Estate Appraiser

S.P.

Real Estate Agent and Analyst

Looking for a Customized Consultation?

We are ready to discuss our solutions in detail and assist in selecting the most suitable product for your requirements.